Our Feie Calculator Diaries

Wiki Article

The 6-Second Trick For Feie Calculator

Table of ContentsSee This Report about Feie CalculatorUnknown Facts About Feie CalculatorFeie Calculator Fundamentals ExplainedOur Feie Calculator PDFsFeie Calculator - Questions

US expats aren't limited only to expat-specific tax breaks. Commonly, they can declare a number of the exact same tax credit reports and deductions as they would certainly in the US, including the Youngster Tax Obligation Credit (CTC) and the Lifetime Learning Credit Report (LLC). It's feasible for the FEIE to decrease your AGI so much that you do not certify for certain tax obligation credit scores, though, so you'll need to double-check your eligibility.

The tax obligation code claims that if you're an U.S. resident or a resident alien of the United States and you live abroad, the internal revenue service tax obligations your around the world income. You make it, they exhaust it no issue where you make it. You do get a great exclusion for tax year 2024 - Digital Nomad.

For 2024, the maximum exemption has actually been boosted to $126,500. There is additionally an amount of certified housing costs qualified for exclusion.

Feie Calculator Can Be Fun For Anyone

You'll have to figure the exemption first, since it's restricted to your international earned earnings minus any type of international housing exclusion you declare. To qualify for the international gained earnings exemption, the foreign real estate exclusion or the international real estate deduction, your tax obligation home must remain in an international nation, and you must be just one of the following: A bona fide homeowner of an international country for a continuous period that consists of a whole tax year (Authentic Resident Examination).for a minimum of 330 complete days throughout any kind of period of 12 successive months (Physical Existence Test). The Authentic Homeowner Examination is not suitable to nonresident aliens. If you proclaim to the foreign government that you are not a resident, the test is not pleased. Eligibility for the exemption can additionally be impacted by some tax obligation treaties.

For U.S. people living abroad or making income from foreign resources, concerns frequently arise on exactly how the U.S. tax system applies to them and just how they can make certain compliance while decreasing tax obligation liability. From comprehending what international income is to navigating various tax kinds and reductions, it is very important for accounting professionals to comprehend the ins and outs of united state

Jump to International income is specified as any kind of revenue made from sources outside of the United States. It encompasses a broad range of monetary tasks, including but not limited to: Salaries and incomes made while functioning abroad Rewards, see allowances, and advantages provided by international employers Self-employment revenue derived from foreign organizations Passion gained from international checking account or bonds Dividends from international firms Resources gains from the sale of foreign possessions, such as realty or stocks Earnings from renting international residential or commercial properties Income produced by foreign companies or collaborations in which you have a rate of interest Any type of other income made from international resources, such as royalties, alimony, or betting payouts International gained earnings is specified as revenue gained via labor or solutions while living and operating in a foreign country.

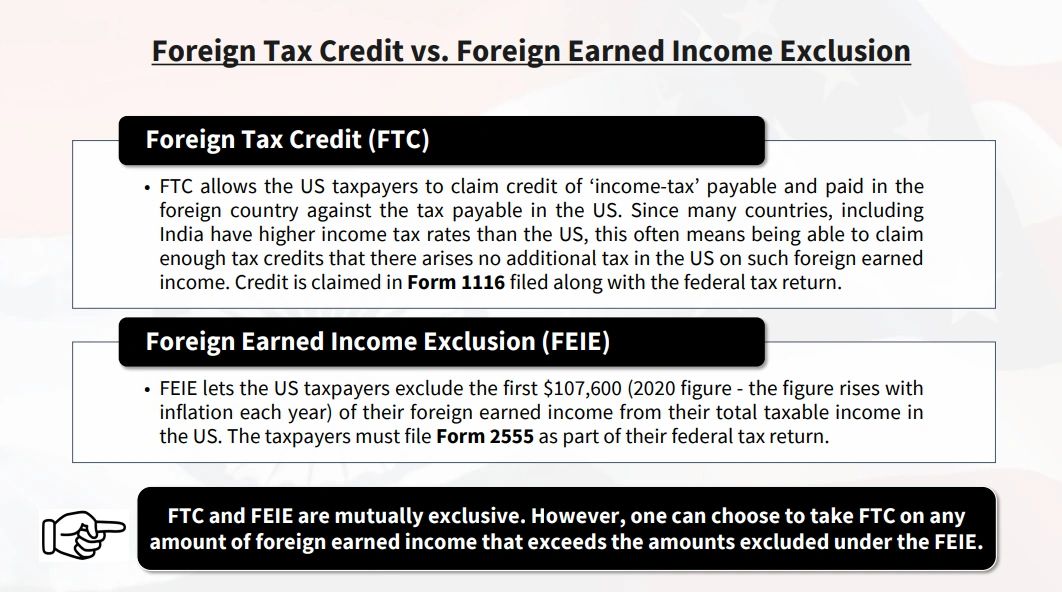

It's vital to distinguish foreign made income from various other types of foreign revenue, as the Foreign Earned Revenue Exclusion (FEIE), a beneficial united state tax obligation advantage, specifically puts on this category. Investment income, rental earnings, and easy income from foreign sources do not receive the FEIE - Physical Presence Test for FEIE. These sorts of income may go through various tax obligation treatment

resident alien that is a person or nationwide of a country with which the USA has an earnings tax treaty basically and that is a bona fide citizen of a foreign nation or countries for an undisturbed duration that consists of a whole tax year, or A united state citizen or an U.S.

Not known Incorrect Statements About Feie Calculator

Foreign earned revenue. You need to have gained income from work or self-employment in an international country. Passive earnings, such as rate of interest, dividends, and rental revenue, does not certify for the FEIE. Tax home. You need to have a tax obligation home in a foreign country. Your tax obligation home is commonly the place where you conduct your routine service tasks and keep your primary economic passions.income tax return for international income tax obligations paid to an international federal government. This credit report can offset your U.S. tax obligation liability on foreign revenue that is not qualified for the FEIE, such as investment earnings or easy revenue. To assert these, you'll initially need to qualify (American Expats). If you do, you'll then submit added tax return (Type 2555 for the FEIE and Kind 1116 for the FTC) and affix them to Form 1040.

The 10-Minute Rule for Feie Calculator

The Foreign Earned Income Exclusion (FEIE) enables eligible individuals to leave out a portion of their international made revenue from U.S. taxes. This exclusion can considerably minimize or get rid of the U.S. tax obligation on foreign revenue. The particular amount of international earnings that is tax-free in the United state under the FEIE can transform yearly due to rising cost of living adjustments.Report this wiki page